Know Your Numbers: The Financial Wake-Up Call Every EC Owner Needs

You're bringing in revenue—enrollment is strong, families are paying on time—but you have no idea if you're actually making money or just running an expensive hobby. You avoid opening QuickBooks because the numbers overwhelm you, and you're making critical pricing decisions based on gut feeling instead of data. Here's what's really happening: you weren't trained to be a CFO, and traditional accounting advice is designed for businesses that look nothing like yours. Confident Early Childhood Operators don't need accounting degrees—they track 5 to 7 key metrics designed specifically for ratio-dependent businesses and can tell you their financial position in under five minutes. When you implement a simplified budget process and build your CEO Financial Dashboard, you stop flying blind and start making confident decisions that actually improve your profit margins.

💡 The 3 Key Strategies You’ll Discover

You'll discover how to identify your 5-7 Core Financial Metrics that actually predict profitability in early childhood businesses—not the 47 reports QuickBooks wants you to track—including enrollment percentage, revenue per child, payroll ratio, and profit margin

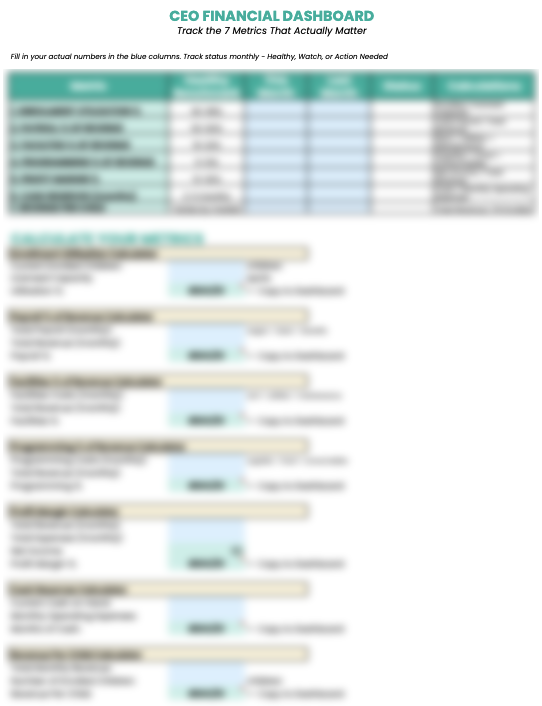

You'll learn how to build your CEO Financial Dashboard that shows you at a glance whether you're profitable, where your money is going, and what needs to change through simple weekly 10-minute check-ins that catch problems early

You'll see how to use your numbers strategically to make confident pricing decisions, identify profit leaks, and improve margins without working more hours using a clear decision-making framework tied to your metrics

⏰ Key Moments & Timestamps

00:00 – Why you're avoiding your financial reports (and why that's costing you)

06:30 – The hidden reason traditional accounting advice fails for EC businesses

13:15 – Strategy #1: Identify your 5-7 Core Financial Metrics

20:45 – Strategy #2: Build your CEO Financial Dashboard

27:30 – Strategy #3: Use your numbers strategically for decision-making

33:50 – How weekly financial check-ins create clarity without overwhelm

Resource of the Week

Financial Dashboard Quick-Start Template

Stop drowning in complex accounting reports and start tracking the 7 metrics that actually matter for ratio-dependent businesses. This simple spreadsheet template helps you set up your CEO Financial Dashboard with healthy benchmarks, weekly tracking columns, and color-coded indicators so you can see at a glance whether you're profitable and where to focus your attention. Includes calculation formulas and examples from preschools, childcare programs, and play cafés.

Final Thoughts

You can't improve what you don't measure. When you identify the 5-7 financial metrics that actually predict profitability and track them consistently, you stop flying blind and start making confident decisions that improve your margins without requiring an accounting degree.

"Financial clarity doesn't come from tracking more—it comes from tracking what actually matters."

🔗 Related Episodes & Resources

How to Price Your Programs for Profit (Not Just to Fill Spots) – Learn the strategic pricing framework that improves margins without losing families

The Budget Mistake Costing You Thousands – Discover why traditional monthly budgeting fails for seasonal early childhood businesses

PBB Module 6: Cash Flow Management – Access the complete financial clarity framework, dashboard templates, and profit improvement strategies inside Shine Membership

💌 Subscribe & Follow

Never miss an episode of Early Childhood Business Made Easy:

🎧 Apple Podcasts | Spotify | YouTube | Google Podcasts

📱 Instagram: @kelleypeake | Facebook: Kelley Peake | LinkedIn: Kelley Peake

If this episode gave you clarity on how to stop avoiding your numbers and start using them strategically, please subscribe and share with another EC leader who needs this financial wake-up call.